INPHO Venture Summit

What's next to invest in Deeptech?8-9 October 2026

Palais de la Bourse – Bordeaux

Relive the Innovation of INPHO 2024

and Get Ready for 2026!

We’re thrilled to share the highlight video from INPHO Venture Summit 2024!

Thanks again for being part of this journey.

We look forward to seeing you on October 8-9, 2026.

After two days of inspiring discussions and pitches at the INPHO Venture Summit, we are pleased to announce the winner:

This achievement reflects INPHO’s commitment to supporting transformative innovations that address critical global challenges. Transmutex’s win underscores the power of technology to redefine our energy future, aligning with the INPHO mission to bring the most impactful deeptech solutions into the spotlight.

Investing in early-stage startups is not about addressing today’s issues, it is about fixing tomorrow’s problems.

The next two years will surely look very different than the past two years.

THE EVENT

Since 2008, INPHO® Venture Summit is a high-end and private gathering where LPs, investors, and large corporations meet to invest in promising solutions to shape the future. The event aims to tackle our world’s most pressing challenges through disruptive technologies.

Appreciated by top decision-makers looking to meet their peers, share insights, analysis, engage in deep and sometimes controversial expert discussions, INPHO® Venture Summit welcomes savvy investors, LPs and corporates interested in deeptech investments, as well as start-ups selected by investors to be challenged live.

As a private event, and in order to maintain a great experience for all our attendees, we have an invite-only format.

Guests

Hand-picked decision-makers interested in transformative technology investment

Speakers

Countries

Billion

Euros Capital raised

Want to Join us?

Private Investors’ Editorial Committee

George Ugras

Managing Director at AV8 Ventures

Hervé Floch

General Manager at Alpha RLH

Géraldine Andrieux

Chief Executive Officer at Blumorpho

Eric Benhamou

Founder at Benhamou Global Ventures

Gemma Garriga

Director Applied AI at Google

François Tison

General Partner at 360 Capital Partner

Mathieu Costes

Partner at Airbus Ventures

Christian Reitberger

Partner at Matterwave Ventures

Hind Beaujon

Chief Sales Officer at Pfeiffer Vacuum Technology

Nicolas Leterrier

Customers, Innovation and ONE Labs global VP at Schneider Electric

Aymerik Renard

General Partner at HCVC

Olivier Tonneau

Founder and partner at Quantonation

Gianluca Dettori

Chairman, General Partner at Primo Capital

Christian Claussen

General Partner at Ventech

Guus Frericks

Founder & Managing Partner at DeepTechXL

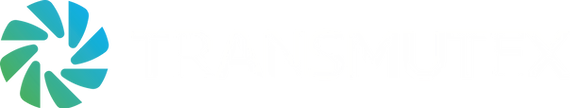

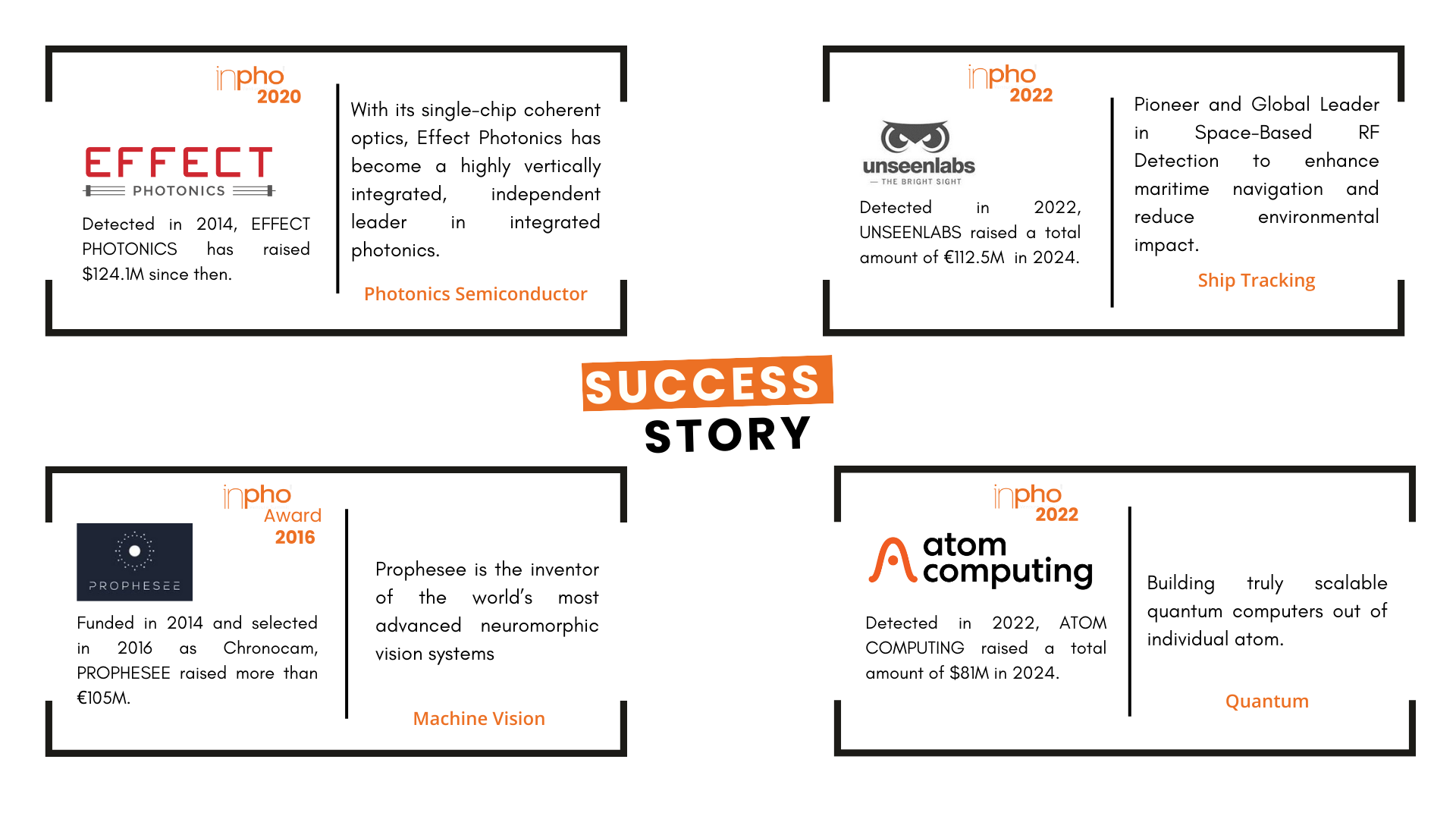

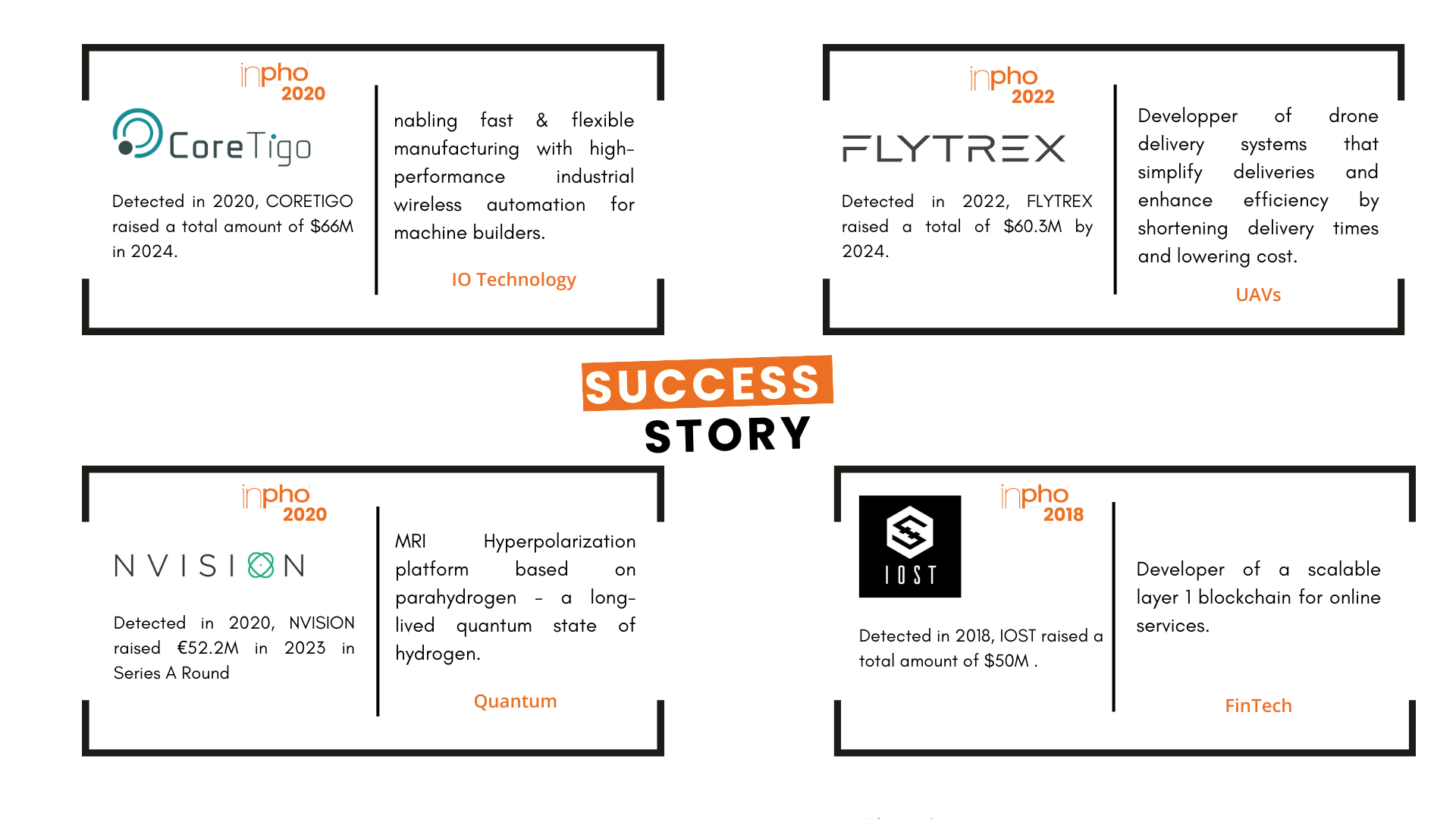

FUNDS RAISED

Be the Next One

They experimented it. This is why they are coming back.

I was really impressed by the diversity of topics from Space Technologies to AI and up to Semiconductor Technologies to give a few examples.

Participants came with all kinds of different backgrounds and countries, so we’ve been able to diversify the conference which adds a lot of flavors to the content. I was also impressed by the caliber of the discussions. It was interesting to assess how to leverage AI in society to address environmental issues but also keeping in mind all the privacy issues.

The location is very nice, Bordeaux is an extremely beautiful city, it is walkable and close to the airport, so from a logistical perspective it is fantastic to come here. It is a nice change from some of the larger cities. But INPHO is especially about people, it allows corporates, venture capitalists and corporate ventures from across the world to reconnect with one another. These connections are valuable for us and for our portfolio companies.

Inspiring… this is the key highlight of INPHO Venture Summit. The quality of the discussion, the diversity of profiles and the quality of the start-up selection is really inspiring to consider new collaborations and new business models. I came a bit out of curiosity after joining The Hive’s Annual Summit in the US, and for sure I will be back in 2 years for INPHO 2024

INPHO is also about the selection of start-ups of high diversity and high quality. It is always a great time to discover companies with new technologies from across different industriesd.

It is the first time I really see a change of mindset. Every company was looked at through the prism of sustainability. I have never seen that before in a tech conference.

What makes INPHO different from other events is the opportunity to meet people from different fields but in a more private atmosphere and with a real openness to discussions. It is really a unique thing.

Disrupt is AI or be disrupted by fast moving companies. Back office transformation is required moving from ERP to driven SAAS. Scalability of operations implies human + Data + Machine learning.

Innovation is a product addressing a need deployed within a new environment. China will become carbon neutral in 2026 whereas Europe is leading on this front. AI = function (Data, Maths, programming, experience…)

INPHO Venture Summit was a very different experience. It felt like a very professional community, fostering a good environment for meaningful exchanges between industry leaders.